Company Tax Audit

Legal and Tax Advice: Verification of revenue using data processing (digital company tax audit) and proper cash accounting

German companies are increasingly faced with growing risks posed by company tax audits. Being notified of a company tax audit therefore causes anxiety in many companies. Nobody appreciates the tax auditor snooping in their documents. There is also the prospect of hefty payments for back taxes based on arbitrary assessments of the company tax audit or even the possibility of criminal tax proceedings. In the end, many issues are a matter of discretion. No company owner or director can assume with certainty, that he is aware of all applicable laws and regulations - including amendments - and has correctly applied all of them.

Our experience as tax law specialists and tax advisers assists you in a company tax audit, including a field audit.

The handling of cash is the focus of attention in audits of smaller companies operating in cash-based industries (bakeries, butchers, cafés, pubs, restaurants, confectionery retailers, tanning studios, retail in general, taxi operators). Tax inspectors frequently accuse companies of having invented their cash accounting out of thin air and justify the accusation with new statistical audit methods such as the “Chi-Square-Test” or “Benford’s Law”. Small errors may result in massive ramifications due to computerised arbitrary assessments made by calculation software and can ultimately threaten economic survival. Additionally, criminal tax proceedings are frequently commenced against the legal representatives of the company. Unfortunately, even tax advisers are sometimes made liable as indemnitors.

Anticipatory planning is paramount for the outcome of a company tax audit - to avoid arbitrary assessments.

The issue of arbitrary assessments is not only a financial risk, but also bears the risk of being subjected to criminal proceedings for tax fraud. In the worst case, if bogus invoices are discovered, the crime of document forgery may be alleged. These matters are always referred to the public prosecutor’s office. This is the time, when an adviser/lawyer/specialist for tax law and criminal tax law should be instructed to coordinate the fiscal and criminal proceedings. The individual methods employed in a tax audit are complex and only an initial overview can be provided here. One of the specialist practice areas of LHP Lawyers and Tax Advisers is the rebuttal of arbitrary assessments in company tax audits.

Facts about company tax audits and audit methods

Cash accounting

How does the company tax auditor conduct an audit of income?

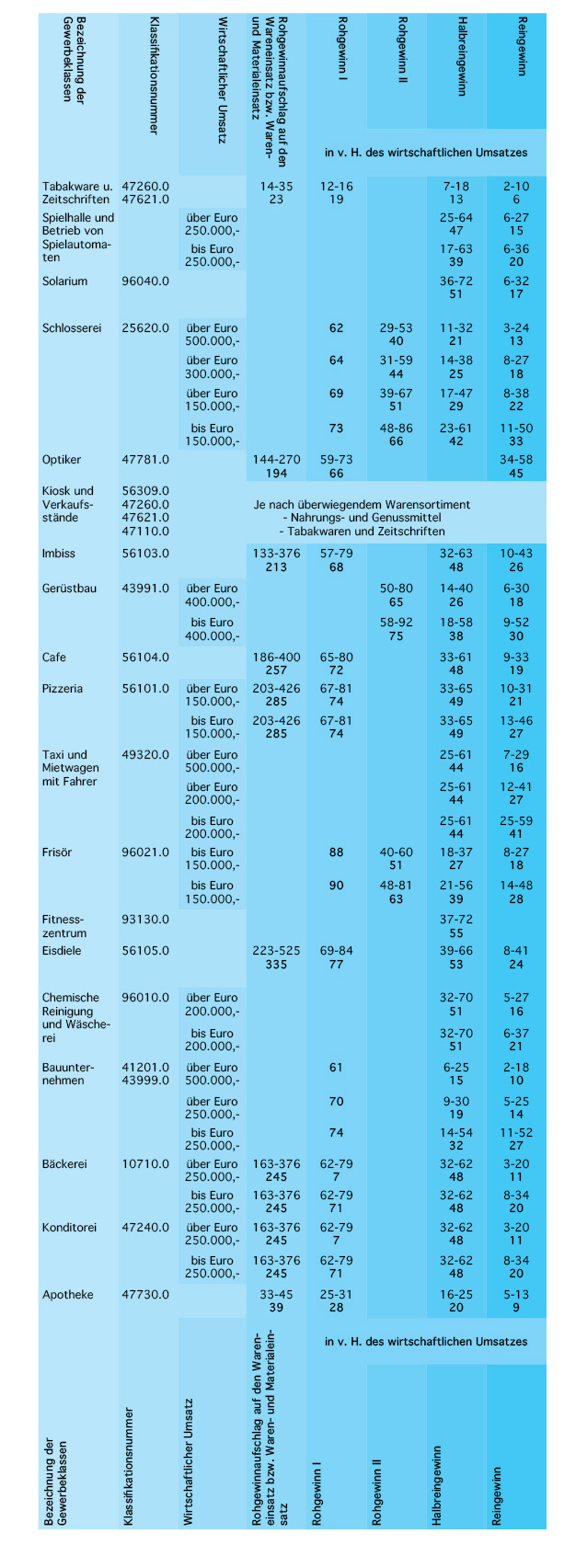

External benchmarking

Internal benchmarking

Calculation of capital gains and cash flow calculation

Validations and arbitrary assessment of revenues

Time-series comparison

Chi-Square-Test (Chi²-Test)

Benford’s Law

As attorneys, tax advisers and tax law specialists, we offer comprehensive advice before, during and after company tax audits:

- at any time, even when a company tax audit has not been expected,

- if a company tax audit has been pre-announced (it might be possible to submit a voluntary self-disclosure if the Tax Authority has merely hinted at a company tax audit over the telephone, but no official notice of company tax audit has been received yet).

- An analysis of the weak points in respect of taxation and criminal tax law as well as corresponding options should be conducted prior to the company tax audit.

- We will develop a suitable strategy.

- We will ensure you have legal certainty at the end of the company tax audit, e.g. by way of obtaining a so-called confirmation letter or by entering into a factual agreement.

- In the worst case, we offer to conduct litigation in respect of objection proceedings and at the Fiscal Courts.

Cologne

An der Pauluskirche 3-5,

50677 Cologne,

Telephone: +49 221 39 09 770

Zurich

Tödistrasse 53,

CH-8027 Zurich,

Telephone: +41 44 212 3535

Source: www.bundesfinanzministerium.de

Source: www.bundesfinanzministerium.de